ASBIS Results in Q2 and H1 2015: major cost reductions but revenues and gross profit still under pressure.

Improvement and profits expected in the second half of the year.

Limassol, Cyprus, August 6th, 2015 - ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, has announced its results for Q2 and H1 2015.

Revenues decreased in both Q2 and H1 2015 compared to the corresponding periods of 2014, by 32.14% and 25.11% respectively. The reason for this was weak market demand in many geographies, coupled with fierce competition on private label brands. However, the first effects of restructuring actions were visible, as in Q2 gross profit grew by 20.18% compared to Q1 2015, though it was still lower y-o-y.

The Company continued to reduce its administration, selling and financial expenses compared to Q2 2014, as they fell by 30.87%, 36.25% and 6.94% respectively, and in H1 2015 compared to H1 2014 fell by 30.23%, 24.19% and 26.57%. More importantly, these expenses were also decreased as compared to Q1 2015.

As a result, the net loss posted for Q2 2015 was much lower than in Q1 2015. Further improvement is expected in H2 2015, as the main problems were resolved and there are signs of recovery in some big markets like Russia. This should allow the Company to deliver profits in both Q3 and Q4 2015.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “In Q2 2015 we put a lot of efforts into solving problems that arose in the beginning of this year. Most importantly, we reduced the excess own brand stock from about USD 45m at the end of Q1 to USD 15m at the end of Q2. This of course has resulted in lower revenues and gross profit. Thus, we had to accept about a USD 3.0 million loss in gross profit resulting from reduced prices. We also successfully addressed the problem with warranty losses, which cost us another million dollars in Q2. But these items should not be a problem in the future. We have also reviewed our customer portfolio and fine-tuned customer credit procedures.”

Kostevitch continued: “Having completed the above and decreased selling, admin and financial expenses, now we are much more optimistic about results in the upcoming periods. Assuming growth in gross profit, with lower expenses and no one-off events, we should deliver profits beginning from Q3 2015. We are optimistic not only because of the visible effects of the restructuring measures we have taken, but also because the situation in Russia has started to show signs of improvement.”

FINANCIAL RESULTS IN Q2 2015 AND Q2 2014 (USD ’000)

Q2 2015 | Q1 2015 | Q2 2014 | Change Q2/Q2 | |

Revenue | 245,353 | 281,809 | 361.535

| -32.14% |

Gross profit | 8,276 | 6,886 | 19,872

| -58.36% |

Gross profit margin | 3.37% | 2.44% | 5.50% | -38.64% |

Administrative expenses | (5,046)

| (5,555) | (7,299)

| -30.87% |

Selling expenses | (6,964)

| (9,940) | (10,924)

| -36.25% |

Profit (loss) from operations | (3,734)

| (8,608) | 1,649

| N/A |

EBITDA | (3,091) | (7,980) | (2,356) | N/A |

Profit (loss) after taxation | (6,941)

| (12,404) | (1,438)

| N/A |

FINANCIAL RESULTS IN H1 2015 AND H1 2014 (USD ’000)

H1 2015 | H1 2014 | Change H1/H1 | |

Revenue | 527,161 | 703,925 | -25.11% |

Gross profit | 15,162 | 42,108 | - 63.99% |

Gross profit margin | 2.88% | 5.98% | - 51.92% |

Administrative expenses | (10,601) | (15,194) | - 30.23% |

Selling expenses | (16,903) | (22,297) | - 24.19% |

Profit (loss) from operations | ( 12,342 ) | ( 4,617 ) | N/A |

EBITDA | ( 11,071 ) | ( 6,103 ) | N/A |

Profit (loss) after taxation | ( 19,346 ) | ( 4,835 ) | N/A |

DETAILED INFORMATION ON SALES PROFILE

A country-by-country analysis confirms that the largest decrease in sales was noted in the markets directly affected by the instability of the major markets. Similarly to 2014, the most dramatic decrease was in Ukraine. However, the Company also saw a decrease in revenue in certain other countries that traditionally were doing very well. Revenues in all of these countries decreased because the Company was focused on selling Prestigio old stock until the end of Q2 2015. It is expected that the strong countries will start growing again beginning from Q3 2015. ASBIS also benefited from operations in Kazakhstan, a market that has increased significantly on the back of the growing iPhone business. This trend is expected to continue, especially because this business can be developed in more countries of CIS.

Region | H1 2015 | H1 2014 | Change % |

Central and Eastern Europe and Baltic States | 230,651 | 314,742 | -26.72% |

Former Soviet Union | 167, 649 | 226,472 | -25.97% |

Middle East and Africa | 79, 474 | 98,796 | -19.56% |

Western Europe | 24, 289 | 50,965 | -52.34% |

Other | 25, 098 | 12,950 | +93.80% |

Total | 527, 161 | 703,925 | -25.11% |

Turbulence in Russia, Ukraine and Europe has adversely affected revenues in all product lines the Group carries, including own brands.

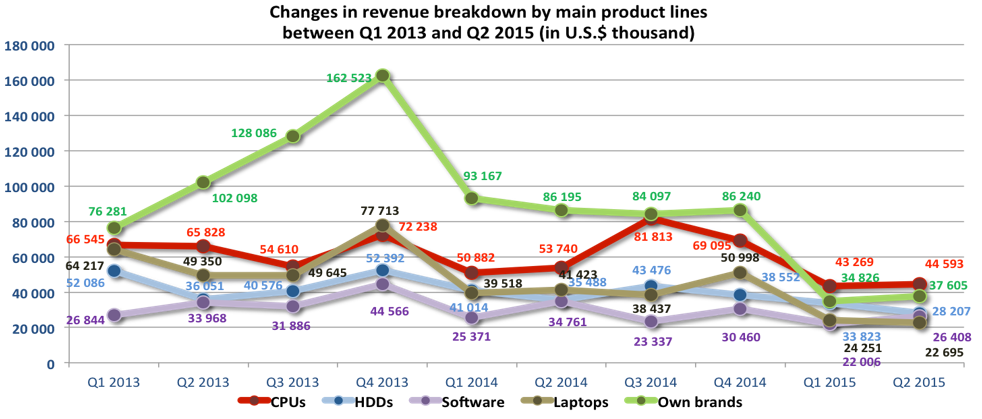

Revenues from all major product lines shown in the chart below showed a decrease compared to the corresponding periods of 2014. These declines are expected to cease, however, as the Company is again fully focused on all remaining product segments after resolving all significant issues. Consequently, there was noticeable improvement towards the end of Q2 2015, and revenues from CPUs, software and own brands grew in Q2 2015 as compared to Q1 2015. This positive trend is expected to continue in H2 2015.

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

E-mail d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide. The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio (smartphones, tablets, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, MultiBoards etc.) and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, about 1,200 employees and 32,000 customers. The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, also visit the company’s website at www.asbis.com or investor.asbis.com

Disclaimer: The information contained in each press release posted on this site was factually accurate on the date it was issued. While these press releases and other materials remain on the Company's website, the Company assumes no duty to update the information to reflect subsequent developments. Consequently, readers of the press releases and other materials should not rely upon the information as current or accurate after their issuance dates.