ASBIS Group in Q3 2014: higher revenues and lower costs result in profit. Crisis in main markets persists, leading to downward revision of forecast

ASBIS saw its Q3 2014 results much improved compared to the previous quarters of 2014, as revenues, gross profit, gross profit margin and NPAT have grown

Limassol, Cyprus, November 6 th , 2014 -- ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, saw its Q3 2014 results much improved compared to the previous quarters of 2014, as revenues, gross profit, gross profit margin and NPAT have grown. The Q3 2014 results were weaker than in Q3 2013 due to continuation of the instability in two major markets of the group, Russia and Ukraine. Revenues in Q3 2014 were USD 388.66 million, down 11.31% from USD 438.24 million in Q3 2013. Revenues for Q1–Q3 2014 were USD 1.09 billion, an 18.87% decrease from USD 1.35 billion in the corresponding period of 2013.

Lower revenues year-on-year resulted in lower profitability on all levels. Gross profit was USD 22.3 million in Q3 2014, compared to USD 28.08 million in Q3 2013. At the same time, the company significantly decreased its expenses and successfully hedged against currency losses. As a result, in Q3 2014 it generated a net profit after tax of USD 494,000, as compared to losses in Q1 and Q2 2014.

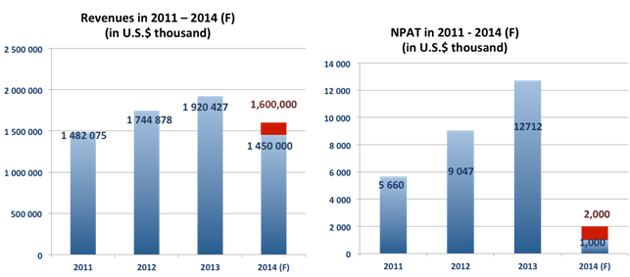

Further growth in revenues and profits is expected in Q4 2014. However, having seen the developments in the marketplace, the management have decided to amend the forecast for FY2014; the company expects to produce r evenues in the range of USD 1.45 billion to USD 1.60 billion, and net profit after tax in the range of USD 1 million to USD 2 million.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “This year is very tough due to dramatically different market conditions than last year and factors that we normally do not face in the business. This resulted in significant losses in Q1 and Q2, and therefore the full-year numbers will obviously be adversely affected. However, we did our job to rescale and rebuild our business, refocusing it more to CEE, WE and other regions, assuming that business in the FSU region will remain stagnant for some time. This action allowed us to increase revenues, gross profit and gross profit margin in Q3 compared to Q2 of this year. Higher revenues and margins combined with lower expenses, following a second wave of cost-cutting actions, have allowed us to generate profit for the first time in this year. We expect this positive trend to continue in Q4 2014.”

Kostevitch continued: “In May, we thought that we would be able to make up for Q1 losses by a quick increase of sales in other regions. However, we have only been able to increase revenues to a certain level without sacrificing margins. We were at the crossroad of choosing between taking excessive risks and delivering higher revenues or limiting the business in the FSU region to sustainable levels. We have decided to stay prudent and build the right basis for growth in Q4 2014 and in 2015. For these reasons, we have decided to amend our FY2014 guidance.”

Financial results in Q3 2014 and Q3 2013 (USD '000)

Q3 2014 | Q2 2014 | Q3 2013 | Change Q3/Q3 | |

Revenue | 388,659 | 361,535 | 438,243 | -11.31% |

Gross profit | 22,297 | 19,872 | 28,081 | -20.60% |

Gross profit margin | 5.74% | 5.50% | 6.41% | - 10.47% |

Administrative expenses | (7,106) | (7,299) | (7,322) | -2.95% |

Selling expenses | (10,456) | (10,924) | (13,360) | -21.74% |

Profit from operations | 4,735 | 1,649 | 7,399 | -36.01% |

EBITDA | 5,112 | 2,356 | 8,094 | - 36.84% |

Profit after taxation | 494 | (1,438) | 3,042 | -83.77% |

Financial results in Q1–Q3 2014 and Q1–Q3 2013 (USD '000)

Q1 – Q3 2014 | Q1 – Q3 2013 | Change (%) | |

Revenue | 1,092,585 | 1,346,721 | -18.87% |

Gross profit | 64,405 | 79,928 | -19.42% |

Gross profit margin | 5.89% | 5.94% | - 0.68% |

Administrative expenses | (22,300) | (21,607) | +3.21% |

Selling expenses | (32,753) | (37,589) | -12.87% |

Profit from operations | 9,352 | 20,733 | -54.89% |

EBITDA | 11,215 | 22,758 | - 50.72% |

Profit after taxation | (4,331) | 7,759 | -155.82% |

Financial forecast for 2014

For 2014, ASBIS forecasts revenues between USD 1.45 billion and USD 1.60 billion and NPAT from USD 1.0 million to USD 2.0 million.

Detailed information on sales profile

A country-by-country analysis confirms that the major decrease in sales was noted in the markets directly affected by the political crisis in Ukraine also affecting Russia. Similarly to H1, the decrease in the Ukraine business has been the most dramatic, since demand in at country was about 50% lower. Additionally, the company decided on more selective sales financed only from local sources. As a result, revenues in Ukraine decreased by 53.70% in Q3 2014 and 45.44% in Q1–Q3 2014, compared to the corresponding periods of 2013. In conjunction to this, revenues derived from the company's single biggest market—Russia—decreased by 22.73% in Q3 2014 and 26.31% in Q1–Q3 2014, compared to the corresponding periods of 2013. On the other hand, the company was able to increase sales in markets that were not directly affected by the crisis in Ukraine, like Poland (+49.09% in Q3 2014 and +136.38% in Q1–Q3 2014), Slovakia (+37.64% in Q3 2014 and +30.16% in Q1–Q3 2014) and UAE (+39.28% in Q3 2014 and +5.83% in Q1–Q3 2014), and even started to grow significantly in countries that were previously affected by this crisis, like Kazakhstan (+59.26% in Q3 2014) and the United Kingdom (+43.65% in Q3 2014).

Country | SALES PERFORMANCE | ||

| Q3 2014 | Q3 2013 | Change % |

Russia | 74,614 | 96,557 | -22.73% |

Kazakhstan | 25,965 | 16,303 | 59.26% |

Poland | 20,758 | 13,923 | 49.09% |

United Kingdom | 18,793 | 13,083 | 43.65% |

United Arab Emirates | 45,381 | 32,583 | 39.28% |

Slovakia | 53,821 | 39,104 | 37.64% |

Romania | 13,860 | 10,653 | 30.11% |

Czech Republic | 16,247 | 19,326 | -15.93% |

Belarus | 13,369 | 19,067 | -29.88% |

Ukraine | 18,013 | 38,902 | -53.70% |

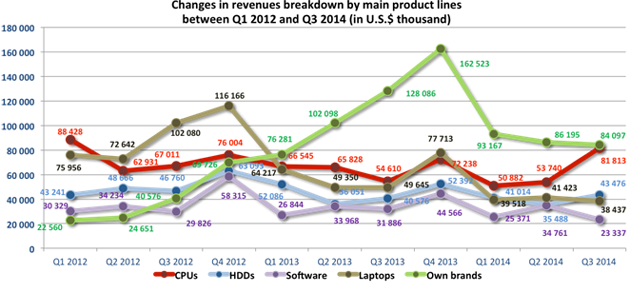

In the 3 rd quarter, trends started shifting to the company's favour, compared to the previous quarters of this year. As a result, in Q3 2014 the company noticed an increase in sales of CPUs and HDDs (compared to both Q1 and Q2 2014), only a minor decrease in own brands and laptops sales, and a decrease in sales of software. For Q1–Q3 2014—compared to Q1–Q3 2013—revenues from all main product lines decreased due to market turbulence.

Revenues from the own brand segment decreased in Q3 2014, compared to Q3 2013, by 34.34%, and the share of own brands business in total revenues in Q3 2014 decreased to 21.64% from 29.23% in Q3 2013; in Q1–Q3 2014 it grew to 24.11%, compared to 22.76% in Q1–Q3 2013. In order to offset the negative effects emanating from the turbulence in Ukraine and Russia, the company has focused on the development of own brand sales in other regions, most importantly in the CEE and WE regions.

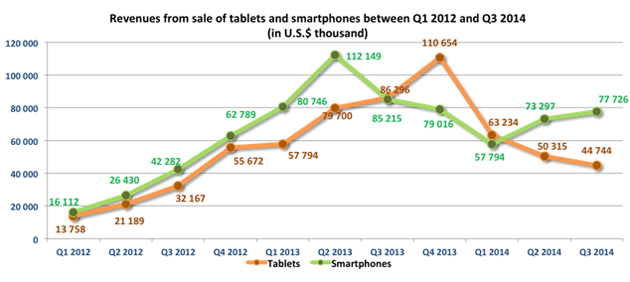

Revenues from smartphones grew in Q3 2014 for the second consecutive quarter and were higher compared to both Q1 and Q2 2014, based mostly on own brand business. Further growth of this segment is expected due to both Prestigio development and an increase of Apple sales mostly in Kazakhstan.

At the same time, revenues from tablets decreased by 48.15% in Q3 2014 and by 29.27% in Q1–Q3 2014 compared to the corresponding periods of 2013. This was connected with lower business in the Ukraine and Russia and marginal growth noted in this market segment due to saturation.

For additional information, please contact:

Daniel Kordel , ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

Tel. +48 509 020 021

E-mail d.kordel@asbis.com

Costas Tziamalis , ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide. The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio smartphones, tablet PCs, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, MultiBoards etc. and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, more than 1,700 employees and 32,000 customers. The Company's stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, also visit the company's website at www.asbis.com or investor.asbis.com

Disclaimer: The information contained in each press release posted on this site was factually accurate on the date it was issued. While these press releases and other materials remain on the Company's website, the Company assumes no duty to update the information to reflect subsequent developments. Consequently, readers of the press releases and other materials should not rely upon the information as current or accurate after their issuance dates.