ASBIS results in Q3 2015: increase in revenues and gross profit with significant cost reductions.

Company returns to profitability. Further improvement expected in Q4 2015.

ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, significantly improved its financial results in Q3 2015 as compared to previous quarters of the year.

Revenues increased by 17.22% compared to Q2 2015 and gross profit improved by 61.28% over the same period. Both decreased as compared to Q3 2014. The improvement in Q3 2015 compared to Q2 2015 was due to improved demand in some markets and an increase in gross profit margin, as the old stock issue was resolved.

The company significantly decreased its selling, administrative and financial expenses compared to both Q2 2015 and Q3 2014. This decrease is especially important in the case of selling expenses, as sales and gross profit have grown. This was possible due to restructuring actions taken over in H1 2015.

Thanks to higher revenues and gross profit, and lower expenses, the company has returned to profitability and posted a USD 2.95 million profit from operations and USD 153,000 net profit after tax, as compared to losses of USD 3.73 million and USD 6.94 million respectively in Q2 2015.

With improvement observed in major markets and the company’s resolution of its biggest issues, further improvement in results is expected in Q4 2015.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “There were two major factors affecting our results in Q3 2015. First, and most importantly, we have sold out old stock and limited RMA expenses, both significantly increasing the GP margin. Our restructuring actions allowed us to further significantly decrease expenses at all levels. These actions have resulted in a positive profit from operations and a net profit after tax. Cash flow from operations has also generated a positive number of about USD 18 million over Q3 and improved our cash position. Despite all these positive developments, the markets are not yet stable enough and there is even harder work ahead of us, but we are confident that this company is able to return to much higher profits in the following quarters.”

FINANCIAL RESULTS IN Q3 2015, Q2 2015 AND Q3 2014 (USD ’000)

Q3 2015 | Q2 2015 | Q3 2014 | Change Q3/Q2 | Change | |

Revenue | 287,606 | 245,353 | 388,659 | +17.22% | -26.00% |

Gross profit | 13,347 | 8,276 | 22,297 | +61.28% | -40.14% |

Gross profit margin | 4.64% | 3.37% | 5.74% | +37.59% | -19.10% |

Administrative expenses | (4,157) | (5,046) | (7,106) | -17.61% | -41.50% |

Selling expenses | (6,244) | (6,964) | (10,456) | -10.34% | -40.28% |

Profit (loss) from operations | 2,946 | (3,734) | 4,735 | N/A | -37.79% |

EBITDA | 3.588 | (3,091) | 5.438 | +216.08% | -34.01% |

Profit (loss) after taxation | 153 | (6,941) | 494 | N/A | -68.96% |

DETAILED INFORMATION ON SALES PROFILE

In Q3 2015 revenues in all the major regions of the company’s operations grew compared to H1 sales. Revenues derived from the F.S.U. region in Q3 2015 were 32.61% lower than in Q3 2014 but 4.16% higher than in Q2 2015. For Q1–Q3 2015, sales to this region decreased by 28.45%. Sales in the Central and Eastern Europe region in Q3 2015 decreased by 14.70% compared to Q3 2014, but grew by 23.67% as compared to Q2 2015. This improvement over Q2 2015 is due to a new product offering following resolution of the issue of old stock. Sales in Western Europe in Q3 2015 decreased by 28.13% compared to Q3 2014, but grew by 63.74% as compared to Q2 2015. For Q1–Q3 2015 sales in Western Europe decreased by 51.96%.

A country-by-country analysis of sales confirms that the decline in sales was significantly lower in most of the markets. The business in Ukraine was strongly affected by negative factors: sales fell by 27.93% in Q3 2015 compared to Q3 2014, but on lower sales the company recorded better results year-on-year from this market. Sales in Slovakia grew significantly, by 21.14%, while the Czech business decreased by 24.89%. Sales in Belarus grew by 6.89%. The devaluation of the Kazakhstan Tenge has impacted this market and thus the company needs time to adapt to new realities. The company’s sales in Kazakhstan decreased by 42.80% in the 3rd quarter.

Further improvement is expected in all the company’s major geographies in Q4 2015, as the old stock issue has already been resolved and the company’s product portfolio has improved.

|

|

|

|

|

|

Central and Eastern Europe | 125,066 | 101,127 | 145,614 | +23.67% | -14.70% |

Former Soviet Union | 90,770 | 87, 144 | 134,693 | +4.16% | -32.61% |

Middle East and Africa | 43,342 | 37,585 | 60,310 | +15.32% | -51.34% |

Western Europe | 15,036 | 9,183 | 30,898 | +63.74% | -28.13% |

Other | 13,392 | 10,313 | 16,145 | +29.85% | -17.05% |

Total | 287,606 | 245, 353 | 388,659 | +17.22% | -26.00% |

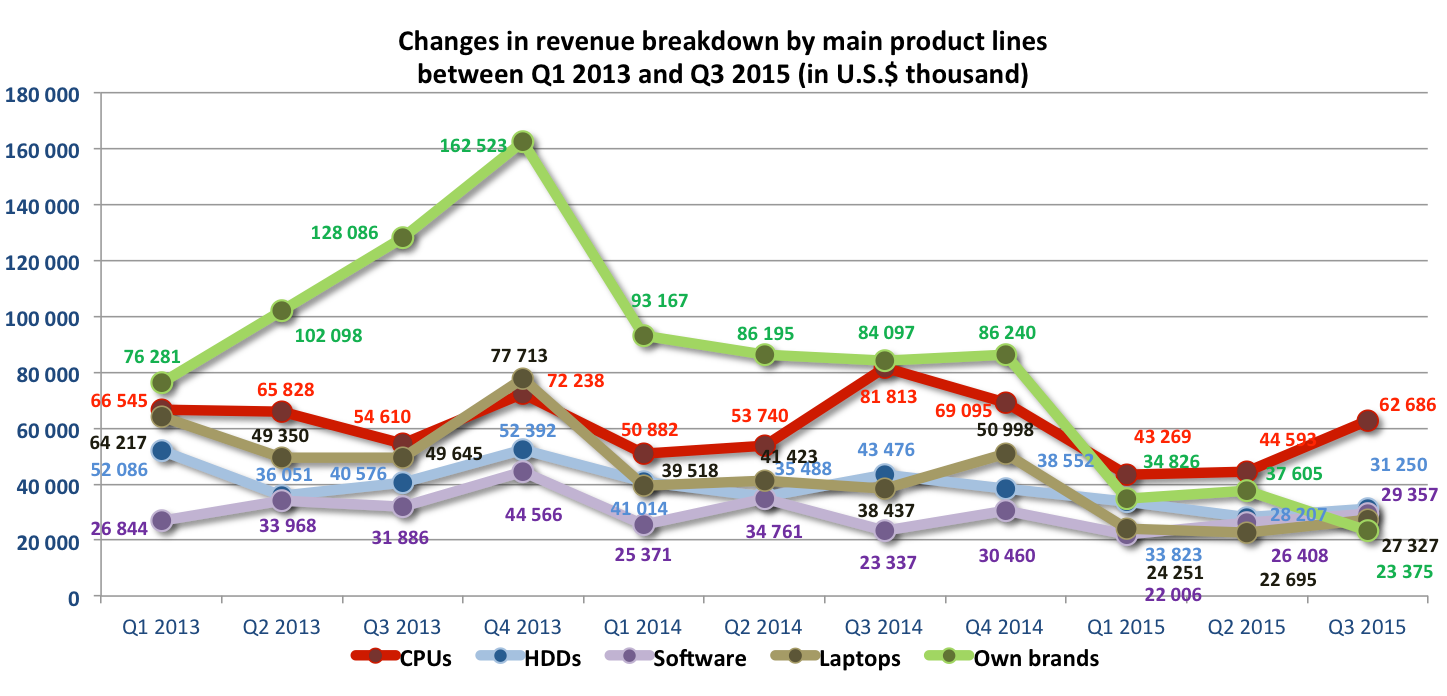

In Q3 2015 the company’s revenues from major product lines – although still lower than in Q3 2014 – showed a growth trend as compared to previous periods of 2015 (revenues from CPUs, HDDs, Software and Laptops grew significantly).

Revenues from own brands sales dropped by 72% in Q3 2015 as compared to Q3 2014 and by 76.85% in Q1–Q3 2015 year-on-year, as the company has decreased the number of product lines offered under own brands and reduced the number of models within specific product lines. This allows the company to focus only on the best-performing models.

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

E-mail d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 60 countries worldwide.The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio (smartphones, tablets, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, MultiBoards etc.) and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, about 1,200 employees and 32,000 customers. The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, also visit the company’s website at www.asbis.com or investor.asbis.com

Disclaimer: The information contained in each press release posted on this site was factually accurate on the date it was issued. While these press releases and other materials remain on the Company's website, the Company assumes no duty to update the information to reflect subsequent developments. Consequently, readers of the press releases and other materials should not rely upon the information as current or accurate after their issuance dates.