ASBIS Results in H1 2017: Double Digit Growth of Revenues, Stable Gross Profit Margins and Expenses Under Control Result in Net Profit after Tax Exceeding U.S.$ 1 million, a 63% Increase Year-on-Year.

Cash flows remain very strong with a positive number in “cash from operating activities” of U.S.$ 10 million for 2Q2017 and more than U.S.$ 14 million improvement in 1H2017 year-on-year. Financial forecast for the year 2017 sustained.

Limassol, Cyprus, August 8th, 2017 - ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, significantly improved its results in 1H 2017. The Group continued to improve its results, while gross profit margins remained stable. While revenues in 1H 2017 grew by 14.66% y-o-y and reached USD 570.3 million, gross profit margin reached 5.30%. As a result, gross profit grew by 10.48% to USD$ 30.2 million from USD 27.4 million in 1H 2016. SG&A expenses remained under control and only grew by 8.71% - due to an increase in revenues and gross profit. As a result, net profit after tax in 1H 2017 amounted to USD 1.01 million as compared to USD 0.62 million in 1H 2016 showing a 62.83% improvement.

Having seen a significant growth in revenues and opportunities in its major markets, the Company fully sustains its financial forecast for the year 2017.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “In 2Q and 1H 2017 we have continued our strategy to grow on our biggest markets and benefit from the market share we have gained during the tough times of 2014 and 2015. The restructuring actions we took in the past, has paid off again. Thus we were able to continue the upward trend in our results. We have not only strongly improved our revenues and profits, but also significantly improved cash flows. Cash from operations for 2Q 2017 was positive and reached USD 10 million, a USD 25 million improvement y-o-y. For 1H 2017 cash from operations was improved by more than USD 14 million. We expect this positive trend to continue and our cash flow from operations to be positive for the year.”

Siarhei Kostevitchcontinued: “We expect our results to continue to improve in 2H 2017, due to seasonality reasons. This should allow us to deliver our financial forecast for this year that assumes net profit after tax of USD5 to 6 million. The strong increase in our key product segments of smartphones with Apple and SSD drives, should help us to achieve this forecast.”

FINANCIAL RESULTS IN 1H 2017 AND 1H 2016 (USD million)

1H 2017 | 1H 2016 | Change 1H/1H | |

Revenue | 570.3 | 497,4 | +14,66% |

Gross profit | 30.2 | 27.4 | +10.48% |

Gross profit margin | 5.30% | 5.50% | -3.64% |

SG&A | 22.3 | 20.6 | +8.71% |

Profit from operations | 7.9 | 6.8 | +15.85% |

Profit after taxation | 1.01 | 0.62 | +62.83% |

DETAILED INFORMATION ON SALES PROFILE

Focus on the F.S.U. region has helped the Company’s very good performance and it showed an impressive 37.25% and 60.05% growth in Q2 2017 and H1 2017 respectively. Following that, the F.S.U. share in total revenues grew to 47.11% in H1 2017 from 33.75% in H1 2016. We have also significantly improved our sales in Western Europe, while our sales in MEA region remained stable year of year. Sales in CEE region decreased by 10.56% in Q2 2017 and 9.37% in H1 2017 as a result of lack of large EU funded projects in Slovakia in H1 2017. Apart from that, sales in other CEE countries have grown.

Country-by-country analysis reveals a better understanding of the above mentioned trends. Growth in F.S.U. has arisen from a continuous improvement in Russia (+15.05% in Q2 2017 and +26.29% in H1 2017), Ukraine (+4.67% in Q2 2017 and +36.79% in H1 2017), Kazakhstan (+223.72% in Q2 2017 and +191,52% in H1 2017) and Belarus (+45.51% in Q2 2017 and +40.78% in H1 2017). At the same time, the decrease in Slovakia (-33.35% in Q2 2017 and -30.13% in H1 2017) has been partially compensated by an increase in the Czech Republic (+6.65% in Q2 2017 and +13.24% in H1 2017), Romania (+11.23% in Q2 2017 and +14.00% in H1 2017) and Bulgaria (+12.83% in Q2 2017). The MEA result is mainly driven by the Company’s revenues in UAE (+26.82% in Q2 2017 and +0.70% in H1 2017).

REVENUES BY REGIONS (USD ‘000)

Region | H1 2017 | H1 2016 | Change % |

Former Soviet Union | 268,691 | 167,878 | +60.05% |

Central and Eastern Europe | 182,653 | 201,537 | -9.37% |

Middle East and Africa | 73,622 | 80,440 | -8.48% |

Western Europe | 41,624 | 29,631 | +40.47% |

Other | 3,742 | 17,928 | -79.13% |

Grand Total | 570,331 | 497,414 | +14.66% |

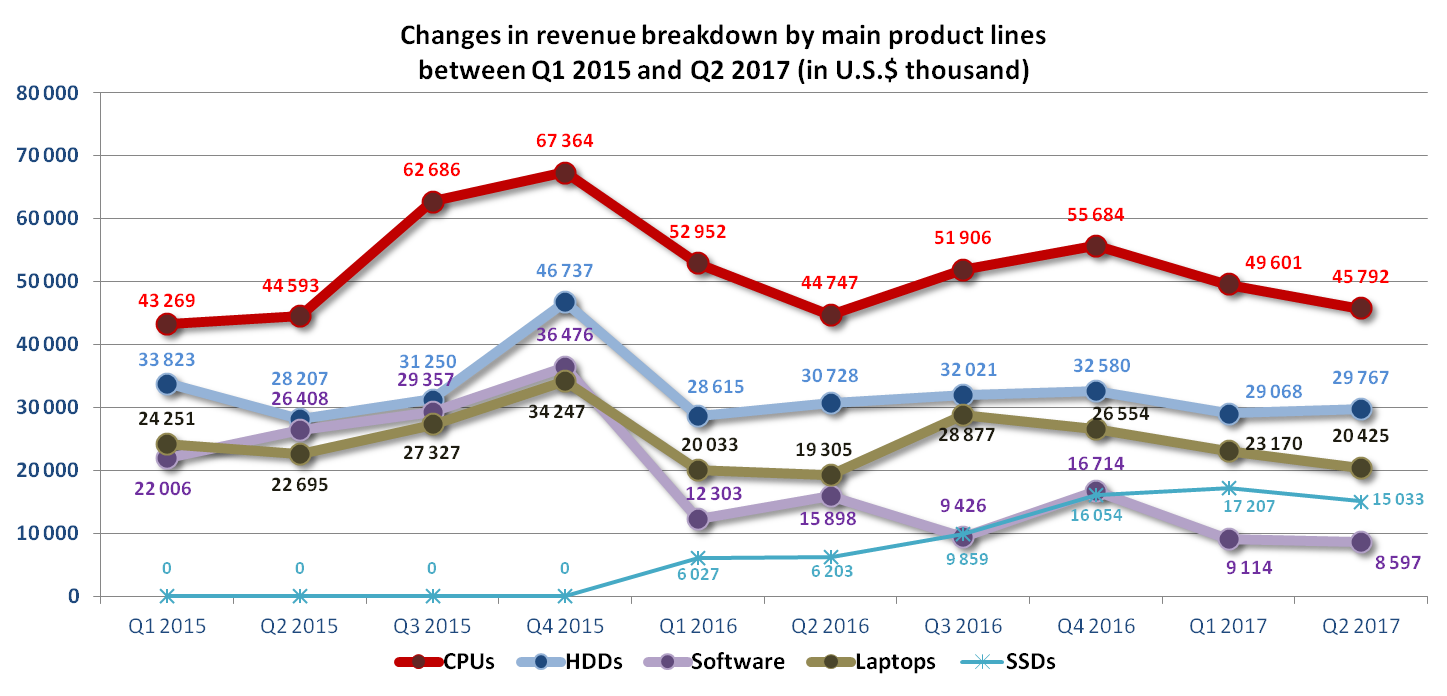

Growth in H1 2017 sales was driven by sales of smartphones, laptops, SSDs and other smaller product lines, while sales of typical components were relatively stable year-on-year.

Revenues from CPUs increased by 2.33% in Q2 2017 and decreased by 2.36% in H1 2017. The decrease in revenues from HDDs (-3.13% in Q2 2017 and -5.91% in H1 2017) was offset by an increase in sales of SSDs (+142.34% in Q2 2017 and +163.60% in H1 2017). Finaly, smartphones which is the key driver of sales growth, increased by 68.80% in Q2 2017 and by 55.99% in H1 2017.

From other product lines, the Company has noticed a positive trend for both Q2 and H1 2017 in mainboards and VGA cards (+106.90% and +67.60%), peripherals (+13.22% and +35.29%), memory modules (+67.39% and +84.98%) and accessories and multimedia (+20.05% and +44.78%).

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +48 500 149 140

E-mail d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 60 countries worldwide. The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio (smartphones, tablets, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, MultiBoards etc.) and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 24 countries, about 1,100 employees and 32,000 customers. The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, also visit the company’s website at www.asbis.com or investor.asbis.com

Disclaimer: The information contained in each press release posted on this site was factually accurate on the date it was issued. While these press releases and other materials remain on the Company's website, the Company assumes no duty to update the information to reflect subsequent developments. Consequently, readers of the press releases and other materials should not rely upon the information as current or accurate after their issuance dates.