ASBIS Results in Q3 2016: good trends continued. Gross profit margin soared to 6.11% and resulted in nine times higher net profit.

Further improvement expected in Q4 together with delivery of budgeted numbers.

ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, recorded a very good 3rd quarter and first 9 months of 2016. The Group continued its strategy of focusing on margins. This resulted in high growth in profitability. On revenues in Q3 2016 4.02% lower than in Q3 2015, the gross profit margin grew year-on-year from 4.64% to 6.11%. As a result, gross profit grew by 26.41%, from USD 13.347m to USD 16.872m. Expenses remained under control, and grew much slower than gross profit. Thus, EBITDA grew by 68.84% to USD 6.058m in Q3 2016, as compared to USD 3.588m in Q3 2015. Improvement in gross profitability, coupled with control over expenses, allowed the Company to improve its net profit after tax more than nine times over, from USD 153,000 in Q3 2015 to USD 1,380,000 in Q3 2016.

For the first nine months of 2016 trends were similar: revenues were 5.07% lower year-on-year, while gross profit grew by 55.19%, from USD 28.509m to USD 44.243m. This, coupled with a decrease in expenses, resulted in a USD 21m improvement in the net result. For the 1st 9 months of 2016 the Company posted a net profit after tax of USD 2.001m, as compared to a loss of USD 19.191m in the first 9 months of 2015.

Having seen the results through 9 months of 2016, the Company maintains its financial forecast for FY2016.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “On one hand Q3 was a continuation of what we saw earlier in 2016 – stable revenues, improved margins and net income. On the other hand, the scale of improvement was unprecedented, as were able to keep expenses under control so that they would grow much slower as compared to the strong growth in gross profit. As a result, we are happy to announce a nine times higher net profit”.

“This was not unexpected. This result is just in line with our budget and obviously with our financial forecast for the year. However, we understand it as confirmation to the public that we are getting much stronger – as we promised a year ago. We do expect further improvement in profitability in Q4 2016, and this is expected to allow us to consider returning to a dividend payment after a two-year break”.

FINANCIAL RESULTS IN Q3 2016 AND Q3 2015 (USD ’000)

Q3 | Q3 | Change Q3/Q3 | |

Revenue | 276,052 | 287,606 | -4.02% |

Gross profit | 16,872 | 13,347 | +26.41% |

Gross profit margin | 6.11% | 4.64% | +31.68% |

Administrative expenses | (4,294) | (4,157) | +3.30% |

Selling expenses | (7,055) | (6,244) | +12.98% |

Profit from operations | 5,523 | 2,946 | +87.50% |

EBITDA | 6,058 | 3,588 | +68.84% |

Profit after taxation | 1,380 | 153 | +800.58% |

FINANCIAL RESULTS IN Q1–3 2016 AND Q1–3 2015 (USD ’000)

Q1–3 2016 | Q1–3 | Change Q1–3/ | |

Revenue | 773,467 | 814,767 | -5.07% |

Gross profit | 44,243 | 28,509 | +55.19% |

Gross profit margin | 5.72% | 3.50% | +63.48% |

Administrative expenses | (12,167) | (14,758) | -17.56% |

Selling expenses | (19,734) | (23,148) | -14.75% |

Profit from operations | 12,342 | (9,397) | N/A |

EBITDA | 13,929 | (7,483) | N/A |

Profit after taxation | 2,001 | (19,191) | N/A |

DETAILED INFORMATION ON SALES PROFILE

Following better performance of the F.S.U. countries in Q3 2016, this region regained the first position in the sales structure after impressive 35.92% growth year-on-year. Further improvement in this region is expected in the remainder of the year. Revenues derived from the F.S.U. region in Q1–Q3 2016 were higher by 12.71% year-on-year.

Sales in the Central and Eastern Europe region decreased by 23.92% and 16.59% in Q3 2016 and Q1–Q3 2016 respectively, as compared to the corresponding periods of 2015. Sales in Western Europe in Q3 2016 decreased by 29.80% compared to Q3 2015, but in Q1–Q3 2016 grew by 2.19%. Sales in the MEA region decreased by 10.29% and 2.84% over the same periods.

A country-by-country analysis of sales explains why results in the F.S.U. region improved so significantly. It resulted from continuous improvement in Ukraine, which grew by 169.18% in Q3 and 191.29% in Q1–Q3 2016 as compared to the corresponding periods of 2015. In the same time, the business in Russia started to grow again, and the Company posted an increase of 21.02% and 3.80% in Q3 2016 and Q1–Q3 2016 respectively.

Region | Q3 2016 | Q3 2015 | Change % |

Former Soviet Union | 123,374 | 90,770 | +35.92% |

Central and Eastern Europe | 95,153 | 125,066 | -23.92% |

Middle East and Africa | 38,883 | 43,342 | -10.29% |

Western Europe | 10,555 | 15,036 | -29.80% |

Other | 8,087 | 13,392 | -39.61% |

Total | 276,052 | 287,606 | -4.02% |

Region | Q1–3 2016 | Q1–3 2015 | Change % |

Central and Eastern Europe | 296,689 | 355,717 | -16.59% |

Former Soviet Union | 291,252 | 258,419 | +12.71% |

Middle East and Africa | 119,324 | 122,816 | -2.84% |

Western Europe | 40,186 | 39,325 | +2.19% |

Other | 26,015 | 38,490 | -32.41% |

Total | 773,467 | 814,767 | -5.07% |

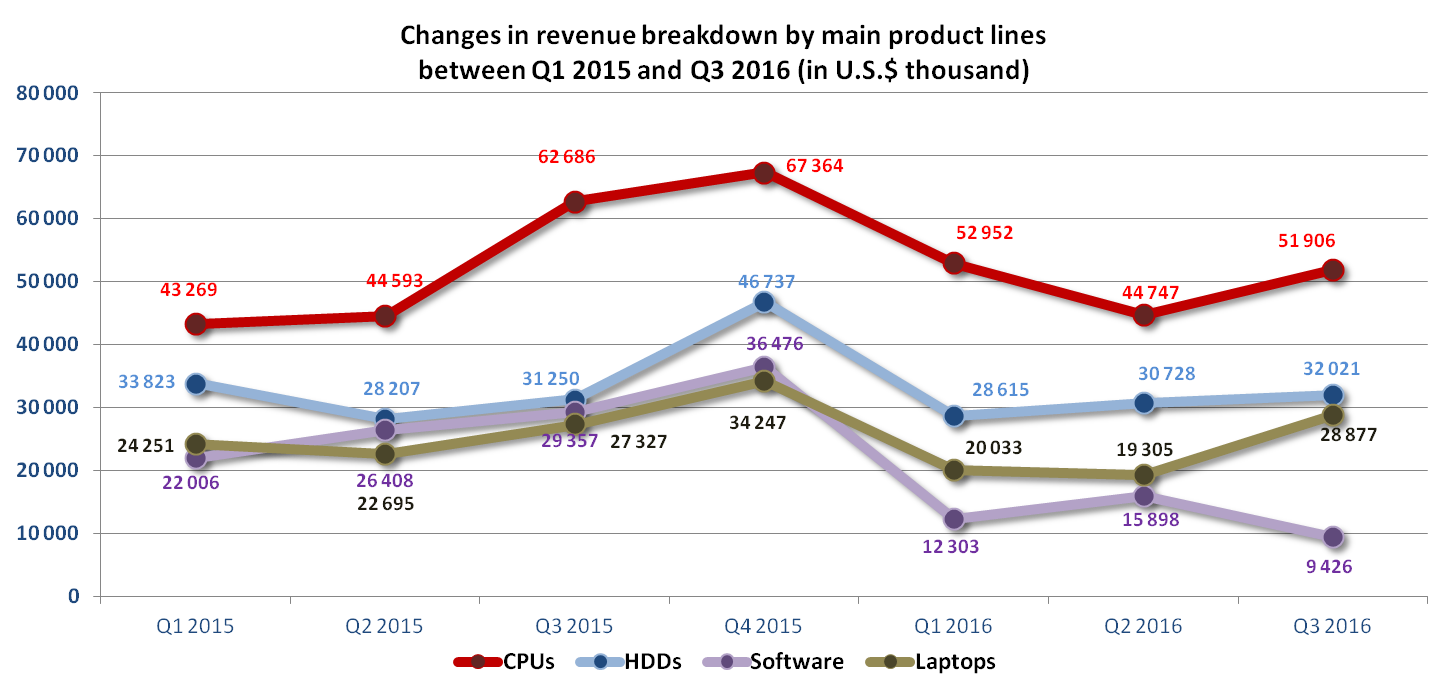

Revenues from CPUs, which traditionally lead in the Asbis revenue breakdown by product line, decreased by 17.20% in Q3 2016 and 0.63% in Q1–Q3 2016. Revenues from HDDs increased by 2.47% and decreased by 2.06% over the same periods. Laptop sales grew in Q3 but were lower for the nine months year-on-year. The smartphone segment in the Company’s sales increased in Q3 2016 by 60.37% year-on-year (mostly following an improvement in iPhone sales) and was stable (+0.28%) in Q1–Q3 2016 year-on-year. Apple became the no. 1 segment in the Asbis portfolio in Q3 2016. This was partially due to introduction of the iPhone 7 by Apple.

From other product lines, the most important growth was recorded in the SSD business, which was built from zero to USD 6.203m in Q2 and USD 9.859m in Q3 2016.

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

E-mail d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 60 countries worldwide. The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio (smartphones, tablets, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, MultiBoards etc.) and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, about 1,100 employees and 32,000 customers. The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, also visit the company’s website at www.asbis.com or investor.asbis.com

Disclaimer: The information contained in each press release posted on this site was factually accurate on the date it was issued. While these press releases and other materials remain on the Company's website, the Company assumes no duty to update the information to reflect subsequent developments. Consequently, readers of the press releases and other materials should not rely upon the information as current or accurate after their issuance dates.