Record Year In The History Of Asbis

Group achieves 74% increase in net profit and meets raised financial forecast for 2018

PRESS RELEASE - 27 February 2019; Limassol, Cyprus

ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, generated record-high financial results for both 2018 as a whole and the 4th quarter of 2018. Sales revenues in 2018 were nearly USD 2.1 billion, as compared to USD 1.5 billion in 2017, an increase of 39%. Gross profit in 2018 grew by 28%, to USD 98.1 million, from USD 76.7 million in 2017. Net profit in 2018 rose by 74%, to USD 12.0 million, from USD 6.9 million in 2017. In 4Q 2018, the Group generated revenues of USD 571.0 million, compared to USD 541.8 million in 4Q 2017, an increase of 5%. Gross profit for the quarter grew to USD 29.3 million, from USD 26.5 million in 4Q 2017 (+11%), while the net profit in 4Q 2018 grew by 29%, to USD 4.9 million, from USD 3.8 million in the last quarter of 2017.

ASBIS remains the distributor of first choice for many global IT manufacturers, and the Group’s strategy is to generate the best possible results for its shareholders. In 2018 the greatest share of the Group’s revenues was in the Former Soviet Union (52% share) and Central & Eastern Europe (28% share). All of the main product lines noted significant sales growth in 2018 compared to 2017. The major growth factor during the year was the sales of smartphones, up 90% from 2017.

The Group is expanding its portfolio of higher-margin own brands and, alongside Prestigio, Canyon and Perenio, plans to launch a fourth brand: Atlantech, which will include products as servers, mass storage, and data centre solutions. The Group achieved its financial forecast for 2018, which was adjusted upward on 31 October 2018 to revenues between USD 2.1 and 2.2 billion and a net profit after tax between USD 11.5 and 13.0 million.

“The last year was a record one for our entire history,” said Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc. “It was a highly intensive period of work for all of us and we are very pleased with what we accomplished. Thanks to the high revenues, we reinforced our position in the markets where we are present. Now we are focusing on maintaining our market share and exploiting the position of leader that we hold on selected markets. The immense growth generated in 2018 was a combined result of making a lot of things right, from servicing large B2B orders to delivering the right products to the right retail chains across all difficult markets we operate. We aim to capitalize on last year’s success by diversifying ourselves towards value-added distribution (VAD) services. We expect that our main strengths will play a leading role in 2019. We anticipate achieving an advantage over competition across all segments of traditional distribution of components. We also expect that our two new own brands, Perenio and Atlantech, along with the existing own brands Canyon and Prestigio, will satisfactorily contribute to the Group’s profitability through exploitation of the Group’s distribution channels.”

DETAILED SALES DATA

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “The regions of the Former Soviet Union and Central & Eastern Europe have traditionally accounted for the largest share of our revenues. That has not changed in the 4th quarter or full-year 2018. In the 4th quarter of 2018 sales in the Former Soviet Union grew by 13%, but in Central & Eastern Europe fell slightly, by 5%. Consequently, for the 12 months of 2018 in the region of the Former Soviet Union sales grew by 51%, and sales in CEE rose by 16% for the year. In connection with these changes, the share of the FSU in our total revenue grew to 52% for the 12 months of 2018. Traditionally, the best country for sales was Russia, followed by Ukraine. We are also increasing our sales in countries of Western Europe and the Middle East & Africa.”

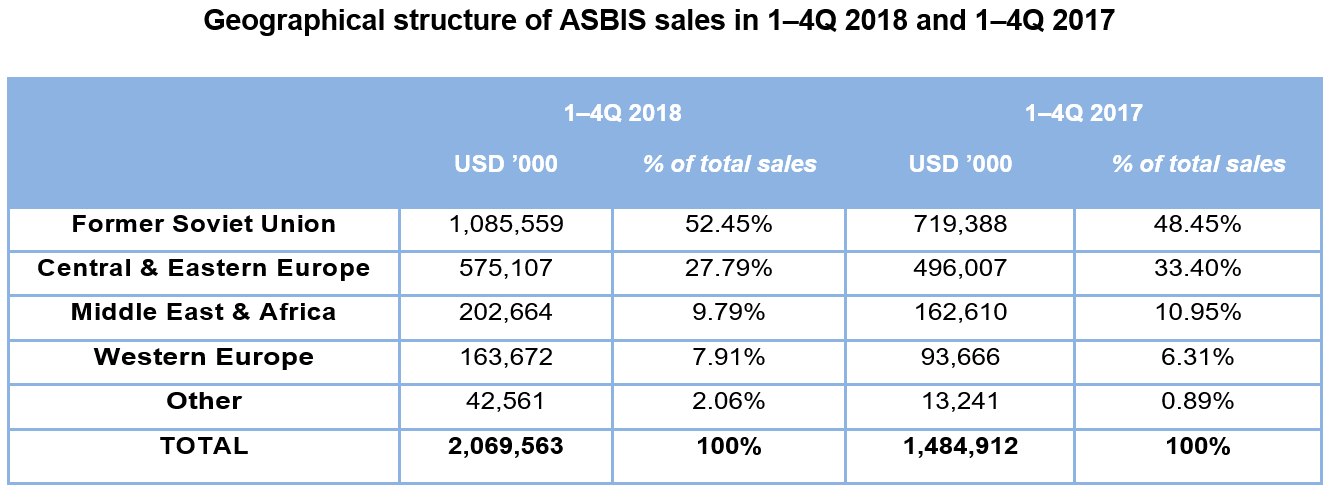

SALES BY REGION

The share of countries from the Former Soviet Union in ASBIS’s total revenues grew to over 52% for the four quarters of 2018, from 48% in 2017. The Group also significantly increased its sales in Western Europe, by 23%, thanks to greater market reach coupled with the decision of certain international suppliers in granting the Group the rights to service Western Europe as well.

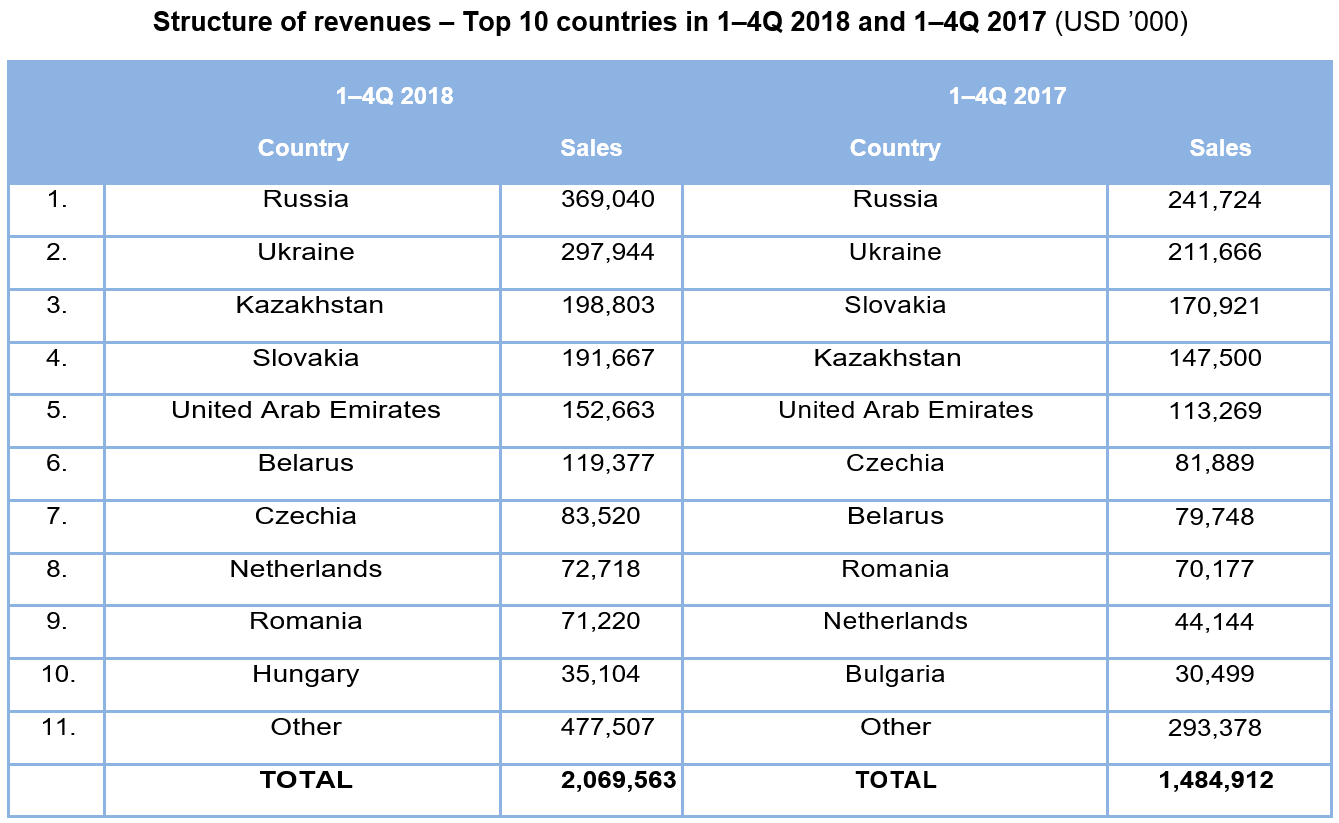

SALES BY COUNTRY

A breakdown by countries provides a better understanding of the trends mentioned above. The growth in FSU countries resulted from continual improvement in sales in Russia (+39.9% in 4Q 2018 and +52.7% for 12M 2018), Belarus (+17.1% in 4Q 2018 and +49.7% for 12M 2018). A slight decline in the 4th quarter of 2018 in Ukraine (-3.6% in 4Q 2018, but +40.8% for 12M 2018.) and Kazakhstan (-4.2% in 4Q 2018, but +34.8% for 12M 2018) was anticipated in light of the high base in the previous periods. Meanwhile, the slight decline in CEE in 4Q 2018, with solid growth in the region for the 12 months of 2018, resulted from the trend in Slovakia (-3.7% in 4Q 2018 and +12.1% for 12M 2018), Czech Republic (-10.1% in 4Q 2018 and +2.0% for 12M 2018), and Romania (-13.7% in 4Q 2018 and +1.5% for 12M 2018), which was restructured at the end of 2018. The result in MEA was mainly driven by revenues in the United Arab Emirates (˗11.6% in 4Q 2018 and +34.8% for 12M 2018), while Western Europe was driven by the results in the Netherlands (+2.1% in the 4th quarter of 2018 and +64.7% for the 12 months of 2018).

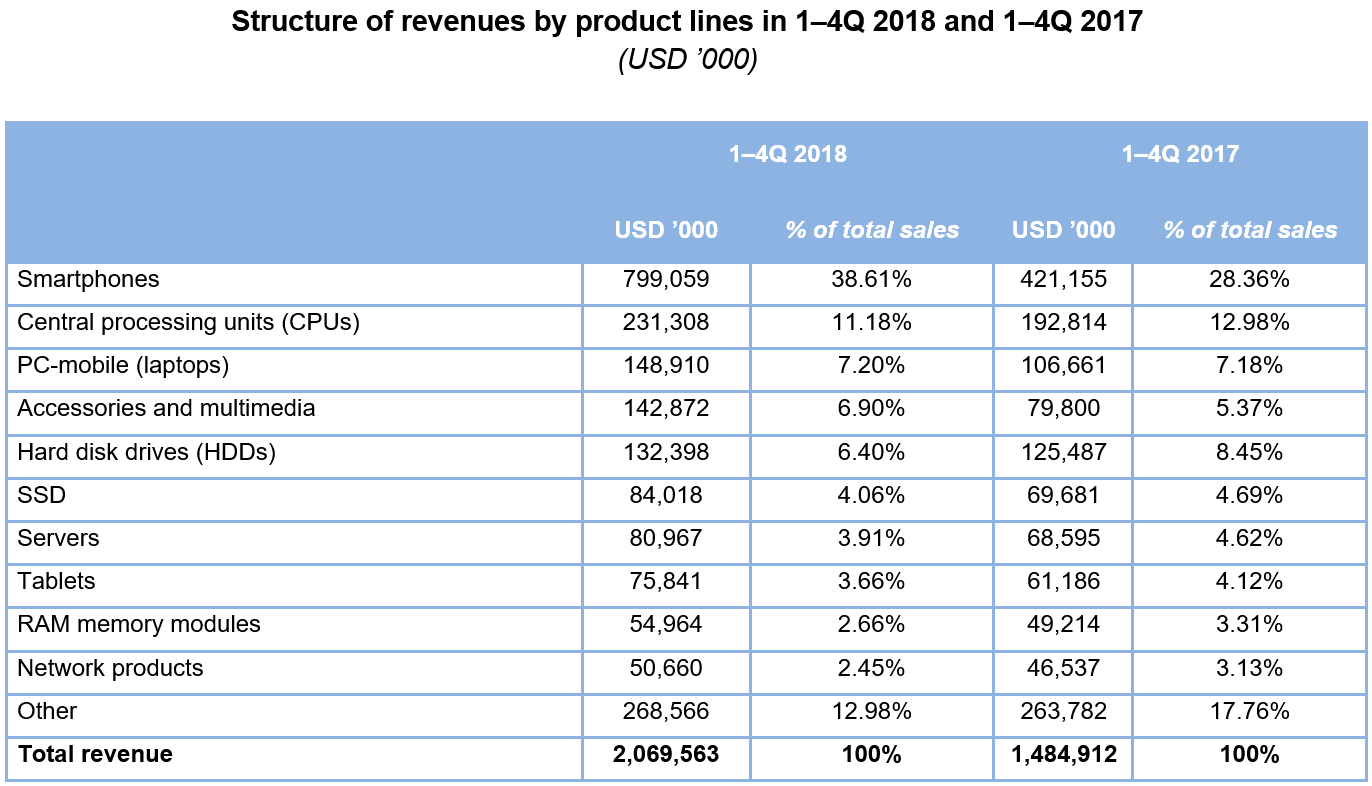

SALES BY PRODUCT LINE

In 2018, nearly all of the Group’s main product lines generated strong growth compared to 2017. The key factor behind the sales growth in the 4th quarter of 2018 was sales of PCs, accessories and multimedia, laptops and software, while the main drivers of growth for full-year 2018 were smartphones, accessories and multimedia, PCs and laptops. Sales of smartphones, a key factor for sales growth, increased by 16% in the 4th quarter of 2018 and 90% during the 12 months of 2018.

The PC business grew 76% in 4Q 2018 and 59% in 12M 2018. The tablet segment noted a decline of 6% in 4Q 2018 but an increase of 24% for 12M 2018. Revenues from sale of CPUs rose 14% in the 4th quarter of 2018 and 20% for full-year 2018. Sales of hard disk drives declined by 19% in 4Q 2018 but grew by 6% in 12M 2018. Software revenue in 4Q 2018 grew 22%, and 0.4% in 12M 2018. Revenues from laptop sales grew 34% in 4Q 2018 and 40% in 12M 2018. SSD sales fell 16% in the 4th quarter of 2018 but rose by 21% for 2018 as a whole.

For more information, please contact:

Iwona Mojsiuszko

8Sense Public Relations

Tel. +48 502 344 992

E-mail: iwona.mojsiuszko@8sensepr.pl

About ASBISc Enterprises Plc

ASBISc Enterprises Plc is one of the leading distributors of IT industry products in the emerging markets of Europe, the Middle East and Africa (EMEA): Central and Eastern Europe, the Baltic republics, the former Soviet Union, the Middle East and North Africa, combining a wide range geographical operations with a wide portfolio of products distributed in the "one-stop-shop" model.

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. The Company was established in 1990, currently selling to 60 countries worldwide.

The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio (smartphones, tablets, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, Multi-boards etc.), Canyon (MP3 players, networking products and other peripheral devices), Perenio („IoT”) and Atlantech (servers, data storage, data center solutions).

ASBIS has subsidiaries in 28 countries, about 1,780 employees and 30,000 customers.

The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS). For more information, also visit the Company’s website at www.asbis.com or investor.asbis.com

Disclaimer: The information contained in each press release posted on this site was factually accurate on the date it was issued. While these press releases and other materials remain on the Company's website, the Company assumes no duty to update the information to reflect subsequent developments. Consequently, readers of the press releases and other materials should not rely upon the information as current or accurate after their issuance dates.